Musings of an Intern

26/02/25

“There’s only two things certain in this life, death and taxes.” ~ Benjamin Franklin

Everyday you inadvertently end up paying taxes from GST to Income Taxes to ERP. Have you ever stopped to consider its importance in our society? Well, in its simplest form taxes are a mandatory payment or charge by the various authorities to cover the costs of government activities. But how do governments determine this predisposed tax rate? Lets explore one such theory below.

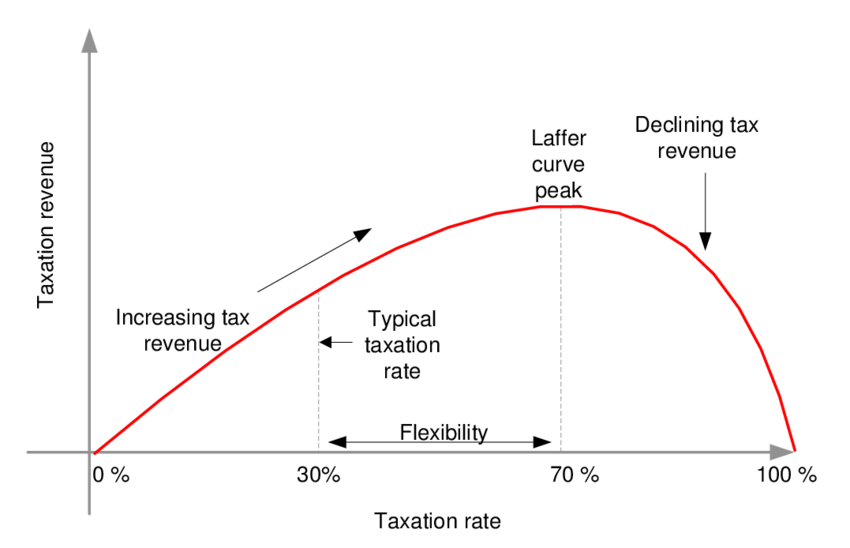

Laffer Curve

First developed by American economist Arthur Laffer in 1974, this curve illustrates the relationship between tax rates and tax revenues collected by governments. The curve suggests that there is an optimal tax rate maximizing revenue and that both 0% and 100% tax rates will result in zero revenue. The curve aims to show that cutting tax rates could lead to increased total revenue due to increased work, output and employment.

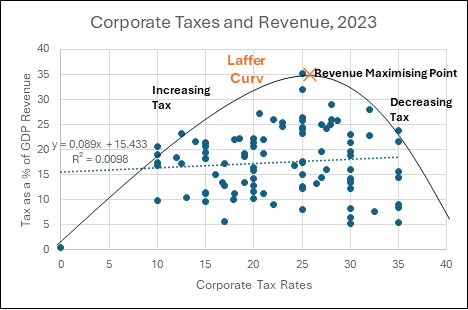

Well now lets look at a figure I made from comparing taxes as a portion of GDP revenue against the prevailing tax rate in 96 such countries. The low R2 value indicates that tax rates alone explain very little of the variation in tax revenue. Other factors, such as economic size, corporate profit levels, and tax enforcement efficiency, play significant roles.

There are several other tax theories that economist look at to determine the optimal tax rate. Optimal Income Taxation (Mirrlees Model) , Optimal Commodity Taxation (Ramsey Rule), Capital Income Taxation (Chamley-Judd Result) and many others. Singapore for example Singapore follows the Chamley-Judd Result which implies that having zero taxes on capital gains ensures long-term economic growth by encouraging capital accumulation and investment and maintain global competitiveness, especially as a financial hub and investment destination.

Looking further into Singapore, many multinationals’ corporations (MNCs) operate here and increases in income taxes could lead to wage pull inflation further increasing costs and drive many investors away. Singapore also has a narrow tax pool where the lower income and middle-income residents are hardly taxed, if any at all. Whilst Singapore has increased taxes in recent years, these changes could be taken with a pinch of salt and still allowed for increased in tax revenue without deterring employment and output levels. However, considering that Singapore is often considered a tax haven due to globally low taxes for OCED countries and the vast amount of rich individuals in Singapore where tax revenue is derived from, large increases could lead to very quick dip in the tax revenues. One could also say that Singapore offers vast opportunities and safety that would cause people to stay and given the nature of Singaporeans, its political stability and automated taxes collected, tax evasion would be low and wealthy individuals would remain rooted here.

Well at the end of the day, these theories can only act as guidelines to nudge each country in the right direction. Economists actually have it hard as it is not easy to derive the actual impact differing tax rates will have on the economy. To apply these and other theories into practice, economists use numerical simulations and calibration methods through computational models to simulate the economy under different tax policies and by adjusting model parameters to match real-world data. However, the only possible way to investigate such changes would be to truly implement them.

See you next time,

S!